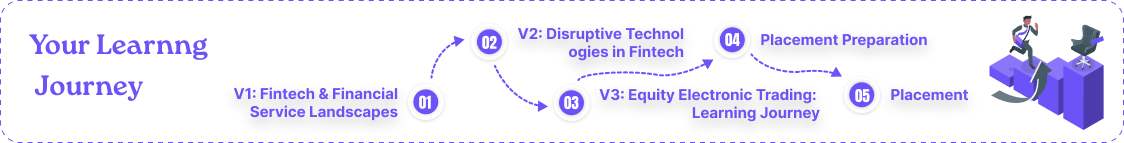

What are

Disruptive

Technologies

Disruptive technologies are innovations that radically change

industries by offering new, more efficient solutions. Examples

include blockchain, AI, IoT, 3D printing, renewable energy,

biotechnology, and quantum computing.

This volume will

cover:

Introduction to

DISTRUPTIVE TECHNOLOGIES

Disruptive technologies are

primarily developed and

adopted in various sectors,

serving as catalysts for

transforming industries.

One prominent example is the

Internet of Things (IoT), which

connects various devices and

enables them to communicate

and share data.

IoT connects devices for data

exchange. Platforms like AWS,

Azure, and Google Cloud

manage connectivity, data

processing, and analytics.

Know More

Distributed Systems

Distributed fintech systems emerged in the late 20th century, leveraging networked computing to enhance financial operations and services.

Building Blocks of Distributed System

Distributed systems handle vast data and operate across multiple machines or continents, facilitating collaborative computation. Yet, their complexity poses challenges in both design and maintenance.

Domain-Driven Design (DDD)

DDD is a software development approach that prioritizes understanding the problem domain for effective solutions through collaboration between domain experts and developers.

The Fintech Landscape and Domain Complexity

Fintech's vast landscape includes banking, payments, lending, and wealth management, demanding deep understanding and strategic navigation due to complexity and regulatory challenges.

Introduction to Cloud Computing:

Cloud computing utilizes remote servers for storing, managing, and processing data, enabling flexible and scalable digital solutions.

AI and Machine Learning in Fintech

Fintech employs AI and ML for data analysis, fraud detection, risk assessment, and personalized financial services.

Understanding Blockchain Technology

Blockchain is decentralized, transparent ledger for secure, immutable transactions, eliminating intermediaries and enhancing trust in data integrity.

Disruptive Technologies

Disruptive Technologies Reshaping Investment Strategies

Disruptive technologies like AI, blockchain, and big data

analytics are revolutionizing investment strategies. AI

enables data-driven decisions and trend predictions,

while blockchain enhances transaction transparency

and security. Big data analytics offers insights from

diverse sources, empowering investors to adapt

to market dynamics. Embracing these technologies is

crucial for staying competitive and unlocking growth

opportunities in the evolving investment landscape.

Powering Electronic Trading

in

the Digital Age

In today's digital age, electronic trading reigns supreme, propelled by disruptive technologies like AI, blockchain, and big data analytics. AI algorithms swiftly analyze market data, while blockchain ensures transparent and secure transactions, reducing the need for intermediaries. Big data analytics provides valuable insights, aiding investors in making informed decisions. These technologies revolutionize electronic trading, enhancing efficiency,transparency, and empowering investors to navigate the financial markets with confidence.

Empowering Individuals:

Driving

Financial Inclusion

Disruptive technologies democratize financial inclusion, empowering individuals worldwide to access banking services, invest in assets, and achieve economic autonomy.

Moreover, Disruptive Technologies are pivotal in democratizing financial access and fostering inclusion. By granting individuals the ability to engage in diverse financial activities, such as investing in stocks and digital assets, these innovations empower economic autonomy and wealth accumulation. Additionally, Disruptive Technologies extend investment opportunities to emerging markets, catalyzing global economic expansion and prosperity.

Future Trends and Innovations

The transformative potential of disruptive technologies like AI, machine learning, and blockchain is revolutionizing investment platforms for a transparent and accessible future.

As technology advances, the potential of disruptive technologies like artificial intelligence, machine learning, and blockchain to revolutionize investment platforms is boundless. These innovations offer unprecedented opportunities to reshape the future of finance, with AI and machine learning optimizing investment strategies and blockchain ensuring transparency and security. Through ongoing innovation, disruptive technologies will continue to redefine how we invest, fueling growth and prosperity in the global financial landscape.