Our Program Highlights:

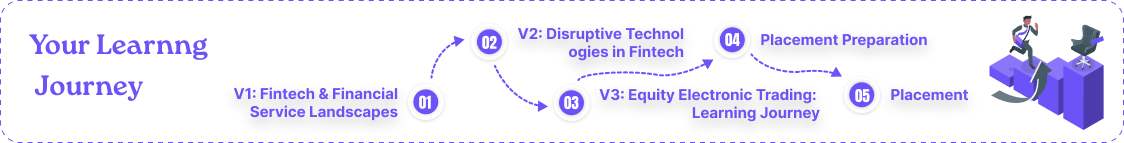

Our Curriculam

V1. Fintech & Financial Landscape

V2. Disruptive Technologies

V3. Insurance:

- Life Insurance

- Property and Casualty Insurance

- Health Insurance

- Commercial Insurance

- Reinsurance

Our Virtual Labs

-

Real-Time Fintech Environment

Gain hands-on experience in labs that simulate real-time fintech environments, mirroring the workflows of leading companies to make you job-ready from day one.

-

24/7 AI Assistance

Benefit from round-the-clock support with an AI assistant available to clarify doubts and guide you through complex technical problems at any time.

-

Comprehensive Software Suite

Work with a wide range of fintech-related softwares, NGINX, MongoDB, Kafka, Jenkins, Angular, React, Springboot, Redis.

-

Cloud Computing Integration

Learn to deploy fintech solutions using top cloud services like Microsoft Azure.

Certification

- Industry-recognized certification

- Enhanced career prospects

Career Opportunities

-

Placement Assistance

Get support with finding jobs and connecting with companies.

-

Expert Guidance

Get advice from industry experts.

Course Prerequisites

-

Educational Qualifications

BTech, MTech, MCA, or any tech graduate

-

Programming Languages

Understanding of Java, Python or other similar programming languages

-

Graduation Year

Experienced and freshers (2023/2024/2025 passouts)

Special Feature

-

Resume Services

Get support with building your resume to suit the fintech markets and preparing for interviews through our mock interview sessions.

-

Skill-Building Focus

The labs are designed to build your practical skills, ensuring you can confidently apply what you've learned in real-world fintech scenarios.

-

Job-Ready Training

The combination of theoretical knowledge and practical lab experience ensures you are fully equipped to excel in the fintech industry from day one.