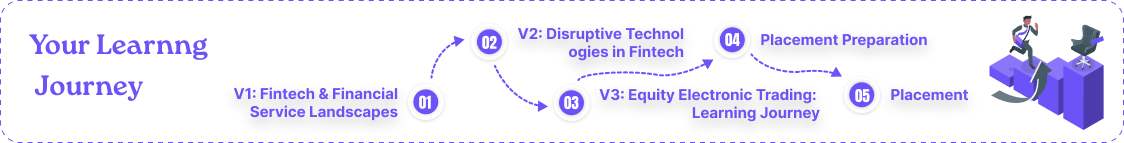

Volume 3

The Specilization

Wealth and Investment

Management

Redefining Finance with Technology

What is Wealth and

Investment

Management (WIM)

Wealth and Investment Management (WIM)

refers to the professional management of

assets and investments on behalf of

individuals, families, corporations, and

institutions to achieve specific financial

goals. This encompasses a wide range of

services aimed at optimizing investment

portfolios, preserving wealth, and generating

long-term returns.

This volume will

cover:

How Technology is Revolutionizing

Wealth and Investment

Management?

Wealth preservation

strategies aim to safeguard

assets for

generations, leveraging

diversification and risk

management techniques.

Digital wealth

management platforms

provide convenient

access to investment

tools and portfolio

tracking, empowering

users to manage finances

on the go.

Alternative investment

opportunities, such as

venture capital and real

estate, offer potential

higher returns and

diversification beyond

traditional asset classes.

Here’s how it

typically works

Accessible

Investment Solutions

Robo-Advisors:

Wealth and

investment management

platforms utilize algorithms

and AI for robo-advisory,

offering automated,

personalized services.

Data-Driven

Decision Making

Advanced Analytics:

Fintech uses AI, big data for

real-time analysis,

informing strategic

investment decisions.

Efficient Transaction

Processing

Blockchain Technology:

Fintech uses blockchain

for secure, transparent

transactions, enhancing

speed, reducing costs,

and trust.

RegTech Solutions

Compliance Automation:

RegTech automates compliance

in fintech, using AI to monitor

regulations, reducing costs,

mitigating risks.

Wealth Preservation

WIM professionals focus on

preserving and growing client's

wealth over time through prudent

investment strategies, risk

management techniques, and estate

planning solutions.

Wealth and

Investment

Management

Enhancing Fixed

Income Markets in

Wealth Management

Fixed Income Electronic Trading transforms bond markets,

offering efficient access to diverse securities, enhancing liquidity,

transparency, and price discovery.

Emerging Trends in Wealth

and Investment Management

Transformation in Wealth

Management: Redefining

Investment Market Dynamics

In contemporary wealth and investment management, Fixed Income Electronic Trading serves as a cornerstone, facilitating capital formation, risk mitigation, and portfolio diversification. It empowers investors to swiftly and securely execute bond trades, irrespective of geography or time zone.

Revolutionizing Wealth Management

Empowering Wealth

Management: Revolutionizing

Fixed Income Trading.

Furthermore, within wealth and investment management, Fixed Income Electronic Trading empowers traders by granting access to advanced trading tools and analytics. This capability allows them to adeptly navigate intricate market conditions and refine their investment strategies.

Future advancements transform

wealth management.

Integration of Fintech Innovations

In summary, technology is revolutionizing wealth and investment management in fintech by democratizing access to investment solutions, enabling data-driven decision-making, streamlining transaction processes, introducing alternative investment opportunities, automating compliance processes, and enhancing client experiences. These technological advancements are driving significant transformation in the wealth management industry, making it more efficient, transparent, and accessible for investors worldwide.