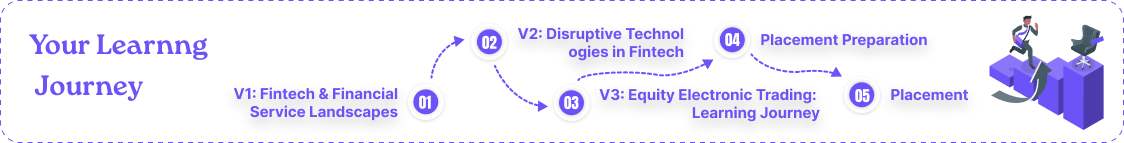

What is Fintech &

Financial Services Landscapes

The finance sector is one of the

most important sectors in the global

economy. It encompasses a broad

range of activities, including banking,

investment, insurance, and asset

management.

This course will

provide a detailed overview of the

finance sector, discussing it’s

history, functions, key players,

challenges and many more.

This volume will

cover:

Introduction to

Finance Industry

The finance industry serves as the backbone of global economies, facilitating the flow of capital, investment, and risk management.

One Prominent example of finance is Digital banks disrupt traditional banking with seamless online services, offering lower fees and higher interest rates for tech-savvy users.

On exchanges, Digital banks use mobile apps and web platforms for seamless banking access.

Know More

History of the Financial Sector

The finance sector has a rich and diverse history, with roots tracing to ancient civilizations.

An Insight into the Financial Sector

The finance sector is a critical part of the global economy, providing essential services to mobilize savings, facilitate transactions, provide credit, manage risk, and offer investment opportunities.

Functional of the Financial Sector

The finance sector mobilizes savings from individuals and businesses and channels them into investments and other financial products.

Key Player of the Finance Sector

The finance sector plays a crucial role in the economy by providing various financial services and facilitating the flow of capital.

Finance Sector Challenges

The financial sector encounters numerous challenges affecting it's stability, growth, and stakeholder satisfaction.

Future of the Finance Sector

The financial sector's future will be influenced by evolving technology, customer preferences, regulations, and global economics.

Financial Services

Embracing the Financial Services Revolution

Fintech innovation has revolutionized financial services,

empowering global access to banking, payments, and

investments. Startups challenge traditional banks with user-

friendly interfaces and lower fees. Regulatory challenges arise

amidst rapid growth, prompting partnerships between

incumbents and startups. Investments pour into fintech, driving

future growth in digital currencies, AI, and open banking.

The Rise of

Fintech Services

Fintech Services:

Revolutionizing Finance in the Digital Era.

In today's digital age, fintech services have transformed the financial landscape, catering to both institutional investors and individual users. With the widespread adoption of internet-connected devices and intuitive platforms, fintech enables seamless access to financial services globally. Additionally, fintech fosters community engagement and information exchange, offering real-time market insights and research tools to empower informed decision-making in investment strategies.

Fintech services democratize financial markets, empowering wealth building and fostering financial independence for individuals.

Empowering

Financial Participants

Moreover, fintech platforms play a pivotal

role in democratizing financial markets and

promoting financial inclusion. By granting

individuals access to investment

opportunities in stocks and securities,

these services empower wealth

accumulation and financial autonomy.

Additionally, fintech platforms extend

investment possibilities to emerging

markets, stimulating economic

advancement and prosperity.

Future Trends and

Innovations

The potential of Fintech drives inclusion,

efficiency, innovation,and security

through tech advancements,fostering

collaboration to empower global finance.

As technology continues to evolve, the future of fintech and financial services are rapidly innovating, becoming more accessible and efficient, shaping a transformative future for global finance, continuing technological advancements drive transformative changes in fintech and financial services, revolutionizing how individuals and businesses manage their finances.This evolution fosters increased accessibility, efficiency, and innovation, expanding financial inclusion and empowering users globally. Through digitalization and emerging technologies like blockchain and AI, the sector is poised to offer more personalized, secure, and seamless financial solutions.