What are

Equities

Equities, commonly referred to as stocks, represent ownership stakes in companies. When individuals or institutions buy shares of a company’s stock, they become partial owners of that company, entitled to a portion of its profits and assets.

This volume will

cover:

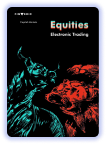

How are Equities Traded

on Exchanges?

Equities are primarily traded

on stock exchanges, which

serve as centralized

market places where

buyers and sellers come

together to execute trades.

One prominent example is

the NASDAQ

exchange, a leading global

electronic marketplace for

buying and selling securities.

On exchanges like NASDAQ,

equity trading occurs

through a sophisticated

electronic platform.

Know More

Listing

Companies wishing to offer their shares to the public apply for listing on the exchange. Once approved, their shares become available for trading.

Order Placement

Investors place buy or sell orders through their brokerage accounts. These orders specify the quantity of shares they wish to buy or sell and the price at which they are willing to transact.

Matching Orders

The exchange matches buy and sell orders based on price and time priority. When a buy order matches a sell order, a trade occurs.

Market Monitoring

Throughout the trading session, the exchange continuously monitors market activity, ensuring fair and orderly trading.

Execution

Trades are executed electronically, often within milliseconds, ensuring fast and efficient transactions.

Regulation

Exchanges are regulated entities, subject to oversight by regulatory authorities to maintain market integrity and protect investors.

Market Data

Real-time market data, including stock prices, trading volumes, and order book information, is disseminated to market participants for transparency and informed decision-making.

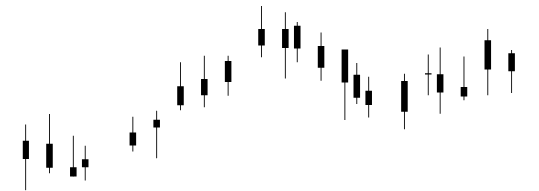

Electronic Trading

Revolutionizing Investment

Electronic Trading stands as the backbone of

modern investment, facilitating the seamless buying

and selling of stocks and securities across

markets. Much like payments technology enables

the transfer of monetary value, Electronic Trading

empowers individuals, businesses, and institutions

to transact in the realm of investments with

unparalleled speed and efficiency.

The Rise of

Electronic Trading

Electronic Trading, the preferred

investment method in today's digital age.

In today's digital age, Electronic Trading become the preferred method of investment for both institutional investors and individual traders. With the proliferation of internet- enabled devices and the availability of user- friendly trading platforms, investors can access global markets from anywhere at any time. Moreover, Electronic Trading fosters collaboration and knowledge-sharing among investors, providing access to real-time market data and research tools to inform investment strategies.

Electronic Trading platforms democratize access to financial markets, enabling individuals to build wealth and achieve financial independence.

Empowering

Investors

Furthermore, Electronic Trading plays a crucial role in democratizing access to financial markets and driving financial inclusion. By providing individuals with the means to invest in stocks and securities, these platforms empower them to build wealth and achieve financial independence. Additionally, Electronic Trading platforms offer opportunities for investors in emerging fostering economic growth and prosperity.

Future Trends and

Innovations

The potential of Electronic Trading, from advancements in technology like AI, machine learning, and blockchain to shape the future of investment platforms

As technology continues to evolve, the future of Electronic Trading holds tremendous potential for innovation and disruption. From advancements in artificial intelligence and machine learning to the integration of blockchain technology, the possibilities are endless for shaping the next generation of investment platforms. With continued innovation, Electronic Trading will continue to revolutionize the way we invest, driving growth and prosperity in the global financial ecosystem.